Dear Members,

My warm greetings to you and your family members.

I have joined the Institute as Chief Executive Officer on 1st October

2020 after having served for more than three decades in SBI in different capacities

and in different verticals. The Indian Institute of Banking and Finance is well

known among the banking fraternity and hence, it is indeed a matter of pride for

me to head this august banking institute which has left its indelible footprints

on the sands of time in its long and meritorious journey of 92 years. The Institute,

with active support from the banking fraternity, will see many more fruitful years.

Let me begin with a quote from George Bernard Shaw,

“Imagination is the beginning of creation. You imagine what you desire;

you will what you imagine; and at last you create what you will.”

Broadly, in line with the above quote, the Mission of the Institute is to develop

professionally qualified and competent bankers and finance professionals primarily

through a process of education, training, examination, consultancy / counselling

and continuing professional development programs. The Institute has kept on reinventing

itself to keep pace with the emerging requirements.

The banking landscape has undergone a paradigm shift in the last decade and is likely

to change significantly going forward. Banks are now on the cusp of transformation

in response to the ever increasing customer expectation, rapidly changing technology,

strict regulatory requirements, advent of new competitors and risk & compliance

management.

A PWC report noted that India would be the world’s third largest domestic

banking sector by 2050.

The ability of the banks to deliver will largely depend on the quality of human

resources. A recent study by BCG has emphasised the importance of improving the

productivity of the workforce in Indian Banks.

Indian Institute of Banking and Finance will try to become the leading institute

to partner with banks to skill the workforce to create a high performance banking

sector ready to face future challenges.

Drawing inspiration from the Vision of the Institute –“To be premier

Institute for developing and nurturing competent professionals in banking and finance

field”, I am now happy to share with you some of the initiatives taken / proposed

to be taken by IIBF.

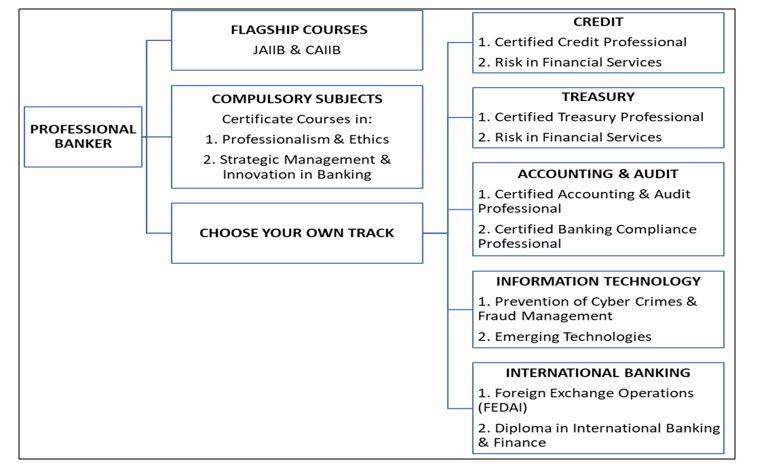

Introduction of Professional Banker Qualification

The “Professional Banker” will be a gold level aspirational

qualification which will epitomize the pinnacle in learning and knowledge. It will

be a unique qualification to plug the long-felt skill gap in mid-management levels

and will provide cutting edge knowledge to professionals in banking & finance

fields.

A banker seeking to achieve status of a “Professional Banker”

needs to have an experience of five years. The route for acquiring the “Professional

Banker” status will be as under:

The details of the qualification will be announced by the Institute in due course.

New course

A certificate on “Resolution of Stressed Assets of Banks, with special

emphasis on the Insolvency & Bankruptcy Code 2016” has been introduced

by the Institute. The date of the first exam will be announced shortly. The

course aims to develop among banking professionals and employees an understanding

of the Code, enable bankers to better understand the procedure to be followed for

resolution of stressed assets and their roles in an insolvency resolution process

and strengthen their capacity to discharge their duties and responsibilities, including

commercial decisions with utmost care and diligence, in the best interests of all

stakeholders.

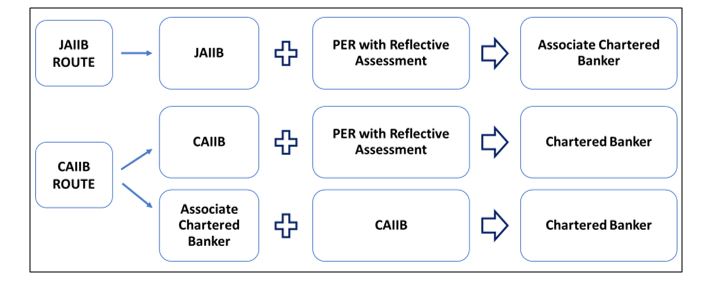

Collaboration with Chartered Banker Institute.

On 27th June 2017, IIBF had entered into a Mutual Recognition Agreement

(MRA) with the Chartered Banker Institute offering a pathway for the Certified Associates

of the Indian Institute of Bankers (CAIIB) from India to have their qualifications

recognised by the Chartered Banker Institute, and be able to become Chartered Bankers

by studying the Chartered Banker Institute’s Professionalism, Ethics &

Regulation module, and successfully completing a reflective assignment.

Taking forward this MRA, a pathway is now being made available for the Junior Associates

of the Indian Institute of Bankers (JAIIB) to also acquire the Chartered Banker

Status through the JAIIB Professional Conversion Route.

The date of announcing the programme will be decided in consultation with the Chartered

Banker Institute and will be announced shortly.

Continuing Professional Development (CPD) Programme

Continuing Professional Development Certificate of the Institute is aimed at enhancing

the professional competence through a formal, structural and verifiable training

program.

In order to make the CPD programme more attractive for the members of the Institute,

the existing guidelines have been revised. For details please visit the Institute’s

website.

Remote Proctored Examinations

The Institute has introduced the remote proctored examinations for 13 of its certificate

courses. The response has been quite encouraging. This will be continued in future

also.

Advanced Management Program in hybrid mode

The Advanced Management Program (AMP) which is one of the flagship courses of the

Institute is now being offered in the hybrid mode. The hybrid mode is a combination

of virtual classroom sessions and Immersion Programmes at IIBF, Mumbai and IIM,

Calcutta. I am happy to inform you that as many as 60 candidates from different

banks/organisations have enrolled for this program. Offering virtual classroom sessions

has made it possible for the banking and finance professionals to join the course

from any part of the country. This will enable the Institute to improve its outreach

and further enhance the knowledge and skill sets of the AMP candidates which will

prove to be a mutually rewarding exercise for the AMP candidates, the banks where

there are employed and for IIBF as well.

Please stay safe and healthy by taking appropriate precautions and by following

the advice provided by your local health authorities

With warm regards,

Biswaketan Das

1st October 2020.

e-Learning

e-Learning

Apply Now

Login

Apply Now

Login