Introduction of the Professional Banker qualification.

Banking functions are becoming more specialised. Therefore, a banker, apart from

having a general knowledge of banking operations, needs to acquire specialised knowledge

in different verticals to remain competitive and be ahead of the curve. Most of

the banks have created dedicated verticals in risk, credit, treasury, international

banking etc. Many verticals in a bank have interlinkages with other verticals. For

example, risk is an integral part of credit and treasury management. Hence, an officer

handling the credit or treasury function in a bank needs to know about the nuances

of risk management also. Thus, acquiring knowledge of interlinked verticals will

help you in acquiring knowledge in specialized areas as well.

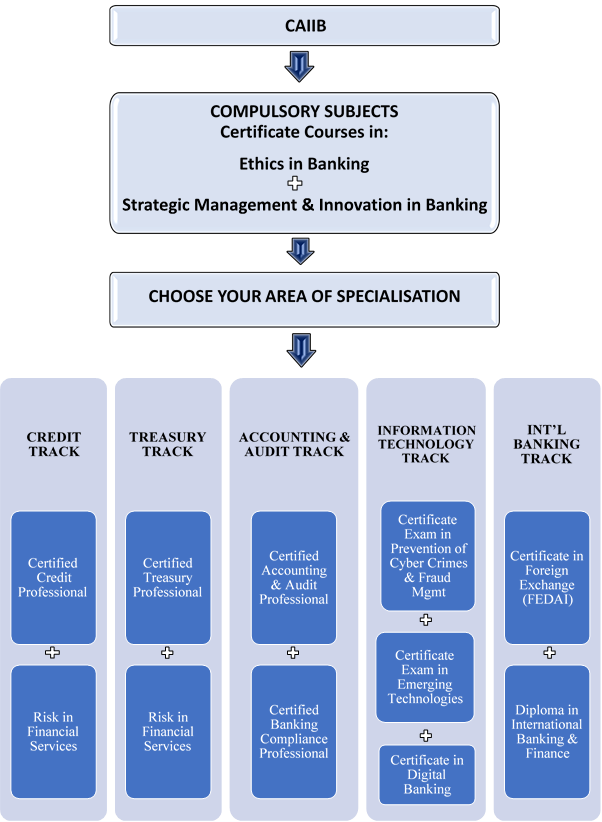

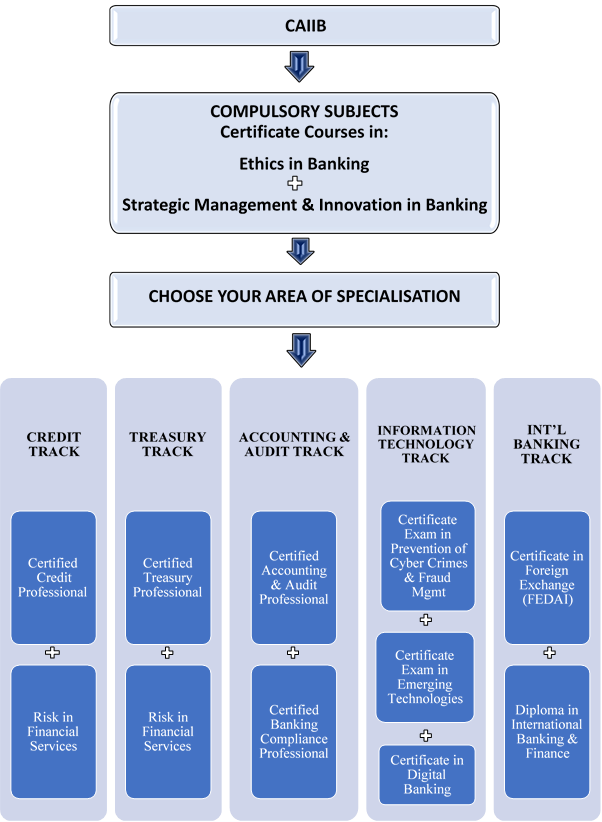

In order to meet the twin objectives of bridging the skill gaps and having a system

of continuous professional development, a gold level aspirational qualification

called “Professional Banker” has now been introduced by the Institute. This qualification

is open to candidates who have five years’ experience and seeks to create a pool

of professionals in specialized and inter-linked verticals to enable them to meet

emerging challenges. A chart depicting the Professional Banker qualification is

given below for your reference.

Introduction of a new certificate course

A certificate course on “Resolution of Stressed Assets of Banks, with special emphasis

on the Insolvency & Bankruptcy Code 2016” has been introduced by the Institute.

IBBI is the knowledge partner for this course.

The certificate course aims to develop among banking professionals and employees

an understanding of the Code, procedure to be followed for resolution of stressed

assets, role of bankers in an insolvency resolution process under the Code and to

further strengthen their capacity to discharge their duties and responsibilities,

including commercial decisions with utmost care and diligence, in the best interests

of all stakeholders. As management of NPAs including its resolution is a critical

activity in banks, this certificate course will help bankers in enriching their

knowledge on the subject.

The examination on the subject is conducted at increased frequencies in the remote

proctored mode.

Introduction of additional certificate courses

The Institute will also be introducing two new certificate courses on:

- Strategic Management & Innovations in Banking

- Emerging Technologies

The first exams on the above subjects has been tentatively scheduled to be held in October 2021.

E-learning

Presently, the Institute offers e-learning covering some of the important courses

/ subjects like JAIIB, CAIIB, Credit Management, MSME, International Trade Finance,

AML/KYC, Prevention of Cyber Crimes and Fraud Management, IT Security, Diploma in

International Banking & Finance etc. We are also in process of developing new

e-learnings on other contemporary topics like Treasury, Risk Management etc.

Joint certification programme by IIBF with XLRI on Leadership

Development Programme

The Institute has tied up with XLRI for developing and co-branding of a program

on soft skills involving leadership / team building with an emphasis on banking

professionals at the mid-level.

The objective of the programme is to transform good managers in banks into effective

leaders, with a human centric approach. The first batch of this programme will start

on 24th July 2021.

Joint certificate programme with Jamnalal Bajaj Institute of Management Studies

(JBIMS) on Advanced Strategic Management for Top Executives of Banks/FIs

IIBF caters to all important verticals in banks through its wide-ranging training

programmes specially designed for the officers working at different levels such

as new entrants, Junior/Middle Management and Senior Management. However, in order

to tread the path to reach the pinnacle, a need was felt to develop a high value,

short duration programme for the Top Management Executives of Banks in the area

of Strategic Management and Leadership.

In order to have such a high quality; high-end programme, the Institute will be

collaborating with Jamnalal Bajaj Institute of Management Studies (JBIMS), one of

the reputed management institutions affiliated to University of Mumbai, for delivering

a short duration Management Development Program on “Advanced Strategic Leadership”

for Top Executives of Banks, Financial Institutions and NBFCs.

The objective of the programme will be to enable the top executives of banks to

have a compelling vision, enhance their capacities to formulate and execute strategies

and lead their organizations across geographic boundaries by anticipating the future

and acquiring a competitive advantage.

The details of the programme will be announced shortly.

Training Programmes

The Advanced Management Programme (AMP), one of the flagship programmes of the Institute

which is conducted in collaboration with IIM Calcutta has been well accepted by

the banking fraternity. The Institute commenced its 10th batch of the Advanced Management

Program (AMP) on 6th June, 2021. The 10th batch of the program

was inaugurated virtually by Mr. Rajkiran Rai G, President, IIBF and Managing Director

& CEO of Union Bank of India. The AMP programme is designed with a focus on

building leadership capabilities at Banks & Financial Institutions.

Besides the AMP, the training vertical of IIBF conducts niche programmes covering

different functional areas of the banks. New programmes on MSMEs, Agricultural Financing

have also been drawn up by the Institute. The Institute has state of the art studios

at its offices at Mumbai, Kolkata and New Delhi. This has enabled trainings to be

conducted in the virtual mode in a seamless and effective manner.

The Institute has devised customized training programmes for various Banks to cater

to their specific needs. The purpose of customized training programmes is skill

upgradation to make the employees ready to deliver on those skills

Research Activities

The Institute has received good response in the following research schemes:

- Micro Research

- Macro Research

- Diamond Jubilee and CH Bhabha Banking Overseas Research Fellowship (DJCHBBORF)

- Scheme for Research in Banking Technology (Jointly with IDRBT)

The results of these schemes will be shortly announced by the Institute.

Collaboration with GARP, USA

IIBF has entered into a MoU with the Global Association of Risk Professionals (GARP),

USA for offering the Financial Risk & Regulations (FRR) program to JAIIB or

CAIIB holders at a preferential rate of USD 300. The FRR program gives an overview

on core aspects of Risk Management viz Credit Risk, Market Risk, Operational Risk

and Asset & Liability Management (ALM). The registration window will be

open until July 31, 2021 after which, the details of registered candidates will

be shared with GARP, USA.

I am happy to state that the collaboration by IIBF with GARP has seen an encouraging

response among the bankers.

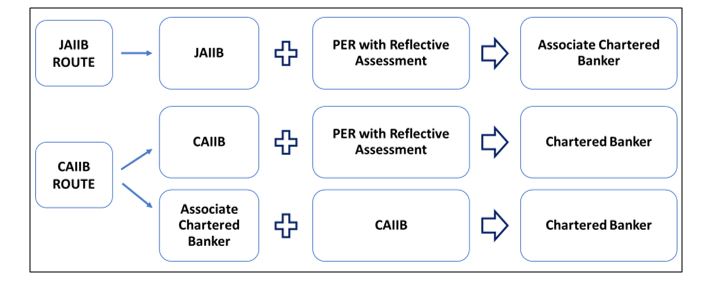

Collaboration with Chartered Banker Institute

On 27th June 2017, IIBF had entered into a Mutual Recognition Agreement (MRA)

with the Chartered Banker Institute offering a pathway for the Certified Associates

of the Indian Institute of Bankers (CAIIB) from India to have their qualifications

recognized by the Chartered Banker Institute, and be able to become Chartered Bankers

by studying the Chartered Banker Institute’s Professionalism, Ethics &

Regulation module, and successfully completing a reflective assignment.

Taking forward this MRA, a pathway has now been made available for the Junior Associates

of the Indian Institute of Bankers (JAIIB) to also acquire the Chartered Banker

Status through the JAIIB Professional Conversion Route.

The JAIIB Professional Conversion Route has also seen a good response.

Lastly, I would appeal to all to please stay safe and healthy by taking appropriate

precautions and by following the advice provided by your local health authorities.

With warm regards,

Biswaketan Das

22nd July 2021.

e-Learning

e-Learning

Apply Now

Login

Apply Now

Login